Donations and Gift Tax in the U.S.

What you need to know

Making gifts to family members or transferring assets can be a great strategy to support your loved ones while improving your tax planning. However, in the United States there are specific rules about the Gift Tax that every tax resident should understand.

This blog explains clearly and simply what the Gift Tax is, when it applies, what the 2025 limits are, and how you can use it strategically in your tax planning.

What is the Gift Tax?

The Gift Tax is a federal tax that applies when you transfer money, property, or other assets to another person without receiving something of equal value in return.

It doesn’t matter if it’s cash, real estate, stocks, or other valuable assets, the IRS considers it a gift.

👉 Example: If you give your child $50,000 to buy a house, that transfer could be subject to the Gift Tax.

Limits and Exclusions for 2025

According to the IRS, there are certain limits before Gift Tax must be reported or paid:

Annual exclusion: You can gift up to $19,000 per person in 2025 without reducing your lifetime exemption. If you’re married, you and your spouse together can give $38,000 to the same person using “gift splitting.”

Lifetime exclusion: The total lifetime exemption is $13.99 million per person in 2025. Gifts exceeding this amount trigger the Gift Tax.

Multiple recipients: You can give $19,000 to each child, grandchild, or other individuals in 2025 without issue.

👉 Example: If you have three children, you could give each one $19,000 in 2025 without it counting against your lifetime exemption.

Accounting Considerations for Gifts

From an accounting standpoint, gifts are not just transfers of money or property, they directly impact how you file your annual taxes and document your estate.

Key points:

Detailed recordkeeping

Each significant gift should be recorded with the date, amount, recipient, and type of asset (cash, real estate, stocks, etc.). This is essential to prove compliance with IRS rules and to correctly apply the annual exclusion.

The IRS notes that all gifts above the annual exclusion must be reported on Form 709.Correct classification

It’s important to distinguish between a personal expense and a taxable gift. For example, paying a family member’s rent is a gift, but paying a grandchild’s tuition directly to the university is not considered a gift and is excluded.Impact on estate planning

Your accountant must coordinate reported gifts with your lifetime exclusion ($13.99M in 2025). This ensures there’s no duplication or confusion when calculating estate taxes upon death.Documentation for audits

Keep receipts, bank transfers, notarized contracts, or appraisals to support the value of gifted assets. The IRS can request evidence, especially for high-value or non-cash assets.

When Must You Report a Gift?

If you give more than $19,000 to an individual in one year, you must file Form 709 – United States Gift (and Generation-Skipping Transfer) Tax Return.

This does not mean you’ll immediately owe taxes; the excess amount simply reduces your lifetime exemption.

👉 Example: If in 2025 you give your daughter $30,000, the first $19,000 is exempt. The remaining $11,000 reduces your lifetime exemption.

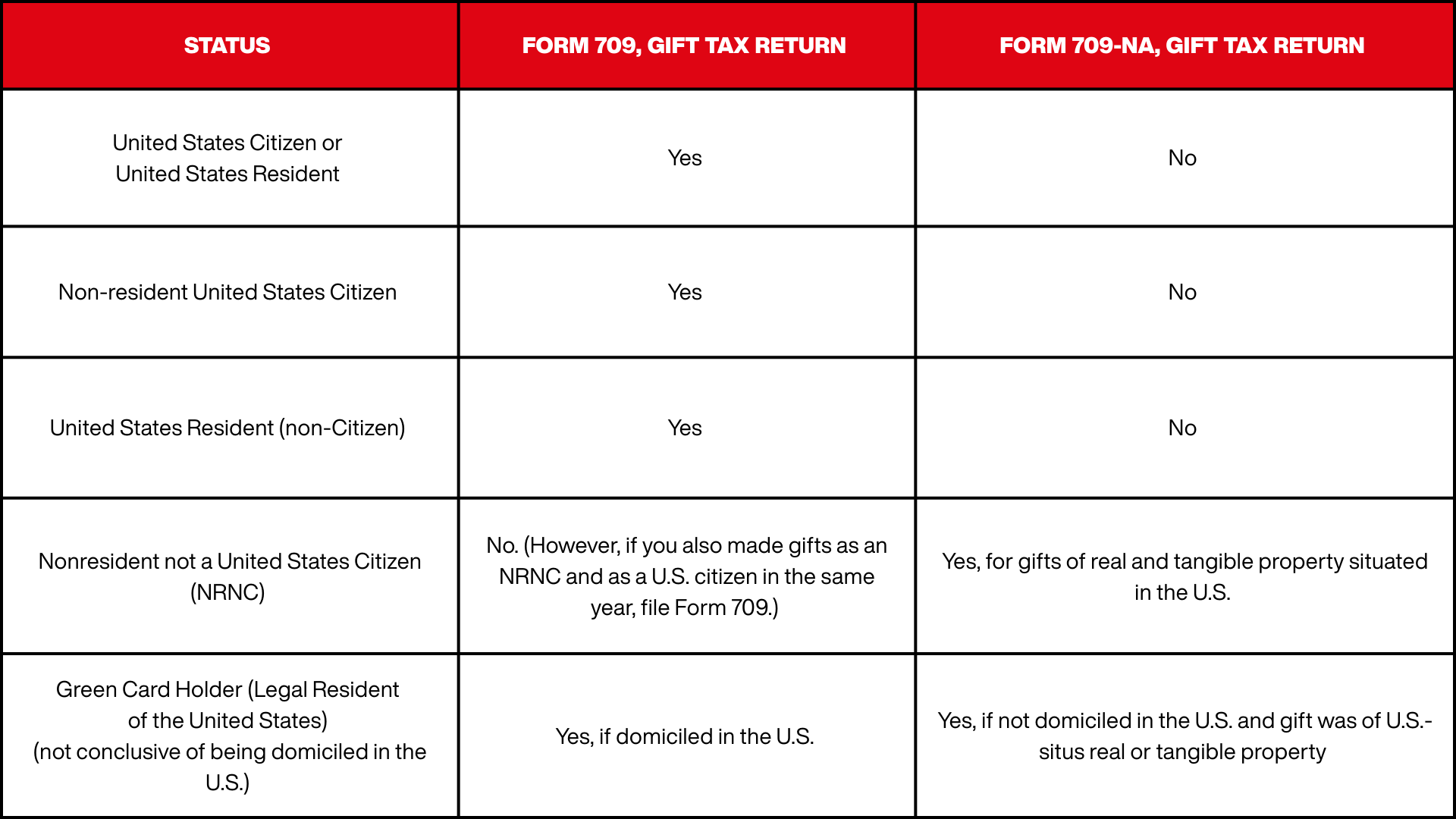

Official IRS Filing Variations

Here is a simplified reference table for who must file depending on status:

*Gift tax | Internal Revenue Service. (s. f.). https://www.irs.gov/businesses/small-businesses-self-employed/gift-tax

Gift Tax Strategies

The Gift Tax can also be a strategic tool:

Reduce estate subject to estate tax

Gifting assets during your lifetime can reduce the taxable value of your estate, and therefore estate taxes.Split gifts across years

You can distribute gifts across multiple years to stay under the annual exclusion and avoid using your lifetime exemption.Direct payments for education or healthcare

Payments made directly to universities or hospitals do not count as taxable gifts. If you pay your grandchild’s tuition directly to the school, it does not trigger Gift Tax.Spousal gifts

Gifts to a U.S. citizen spouse are unlimited and not subject to Gift Tax. (Note: if your spouse is not a U.S. citizen, different rules apply).Strategies for Foreigners

If you are not a U.S. citizen or resident, the Gift Tax only applies to tangible property located in the United States (such as houses or cars). Intangible assets, like stocks or bank accounts, are not subject to this tax.

What to Do Now

✔️ Assess whether you plan to make significant gifts in 2025.

✔️ Keep careful records of transfers so you don’t exceed limits unintentionally.

✔️ For education or healthcare support, make direct payments to the institution.

✔️ Consult with a bilingual CPA in Houston to structure gifts and avoid IRS issues.

At Jambrina CPA, We Help You Plan Gifts Strategically

At Jambrina CPA, we translate IRS rules into practical steps for you:

We explain which gifts you must report and which are excluded.

We prepare and organize your Form 709 filing when required.

We help protect your estate and maximize IRS exclusions.

Subscribe to our newsletter and get new posts delivered straight to your inbox.