IRS Update: Changes for Your 2025 Tax Return

What changed, what stays the same, and how it affects your 2025 tax return

Each year, the Internal Revenue Service (IRS) makes technical and administrative adjustments that directly impact how taxpayers prepare and file their taxes. For tax year 2025, to be filed during the 2026 tax season, the changes focus on inflation adjustments, updated amounts, and greater accuracy in reporting.

Although these changes may seem minor, they have a real impact on how much you pay, how much you can deduct, and how you should begin organizing your tax information now.

Standard deduction

One of the most significant annual changes is the update to the standard deduction, which the IRS adjusts to account for inflation.

In 2024, the standard deduction was lower, meaning a larger portion of income was subject to tax.

For 2025, the IRS increased these amounts:

Single or Married Filing Separately: increases from $14,600 to $15,000

Married Filing Jointly: increases from $29,200 to $30,000

Head of Household: increases from $21,900 to $22,500

This means more income is automatically exempt from federal income tax. For taxpayers who do not itemize deductions, this adjustment directly reduces taxable income.

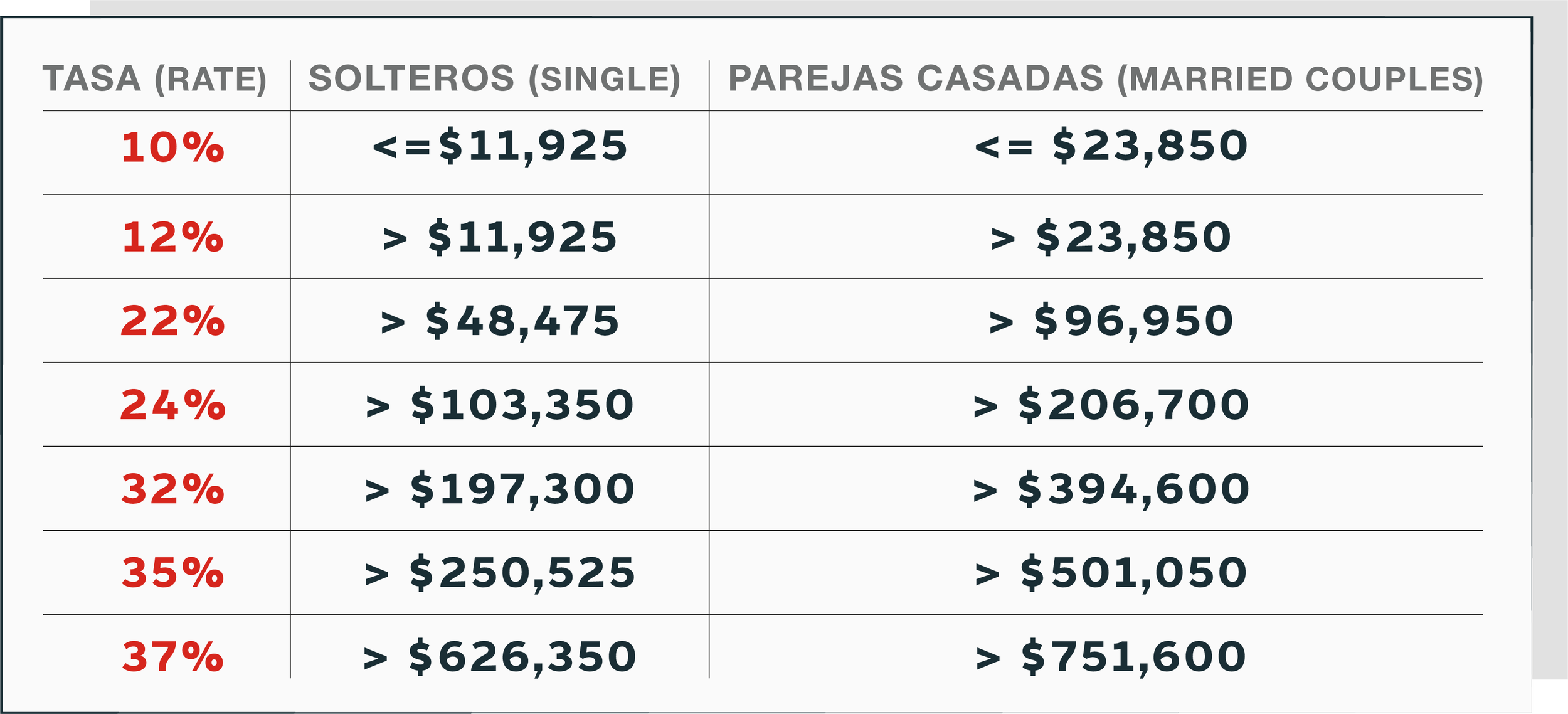

Tax brackets same rates, higher limits

Federal tax rates (10%, 12%, 22%, 24%, 32%, 35%, and 37%) did not change, but the income ranges that apply to each bracket did.

Previously, a small salary increase could push a taxpayer into a higher bracket, a phenomenon known as bracket creep. In practice, this means that an inflation-related raise or bonus does not necessarily result in higher taxes, as long as proper planning is in place.

Adjusted tax credits

The IRS also updated several tax credits, which directly reduce the tax owed (not just taxable income).

The Earned Income Tax Credit (EITC) increases to up to $8,046 for families with three or more children (previously $7,830).

The foreign earned income exclusion increases to $130,000.

The medical FSA limit increases to $3,300.

The transportation benefit is adjusted to $325 per month.

These changes apply automatically, but they can only be fully utilized if the information is reported correctly on IRS forms.

Social Security and Medicare

For 2026, Social Security (6.2%) and Medicare (1.45%) tax rates for employees and employers remain unchanged.

What’s new is that the Social Security wage base increases to $184,500, while Medicare continues to have no wage limit.

These taxes also apply to household workers when $3,000 or more in cash wages is paid during the year.

Digital asset reporting requirements

Taxpayers who bought, sold, or received digital assets, including cryptocurrency, stablecoins, or NFTs, must report those transactions.

Some taxpayers may receive Form 1099‑DA from brokers. Regardless, all taxpayers must answer the digital asset question on Form 1040 and report any related income, gains, or losses.

Jambrina CPA helps you apply these changes correctly

At Jambrina CPA, we support you throughout the year so these IRS adjustments work in your favor. Our team:

Analyzes how tax changes affect your specific situation

Adjusts your tax planning strategy

Reviews your bookkeeping and forms before filing

Helps you avoid common errors and unnecessary IRS notices

All backed by a bilingual CPA who explains each step clearly and guides you with both strategy and compliance.